- Interim cycle of Benchmark assessments provides investors with timely data to inform engagement strategies ahead of upcoming proxy seasons

- Latest assessments reveal progress on net zero commitments, just 6 months after last round, but too often these are not matched by credible transition plans showing how they will be achieved

- Climate Action 100+ launches public consultation to enhance the Net Zero Company Benchmark for the initiative’s next phase, set to launch in mid-2023

Thursday 13 October: Climate Action 100+, the world’s largest investor engagement initiative on climate change, has released an interim set of Net Zero Company Benchmark assessments of its focus companies.

This is the second round of Benchmark assessment to be published in 2022[1]. The timing of this release marks a change of the analysis and reporting cycle for the Net Zero Company Benchmark assessments from March to October, to improve alignment with corporate reporting and better support investor engagement with focus companies.

159 companies on the initiative’s focus list were measured on their progress against the initiative’s three engagement goals and a set of key indicators related to business alignment with the goals of the Paris Agreement.[2]

Progress on commitments not matched by credible plans

Though this interim update comes only six months after the previous release[3], the results are still revealing. While focus companies continue to make progress on net zero commitments, this is not matched by the development and implementation of credible decarbonisation strategies. While mindful of current external factors, including the short-term energy security crisis, investors consider the development of corporate decarbonisation strategies a key priority.

The Benchmark’s Alignment Assessments complement the Disclosure Framework by measuring implementation of Paris-aligned corporate actions. Whilst focus companies are incrementally improving their disclosures under the Disclosure Framework, the latest Alignment Assessments suggest their real-world activities do not yet demonstrate any meaningful shifts in business models at some companies to align with the Paris Agreement.

For example, less than one third of electric utility focus companies have a coal phaseout plan consistent with limiting global warming to below 2°C, whilst only 10% of focus companies have broad alignment between their direct climate policy engagement activities and the Paris Agreement.

However, for the first time, a small number of focus companies provided sensitivities to achieving net zero emissions by 2050 (or sooner), as assessed by CTI’s climate accounting and audit indicator. Although a minority, this is a significant step in the right direction of assessing climate change as a material risk.

The multi-layered analysis via the Disclosure Framework and Alignment Assessments highlights the value of the Benchmark’s dual approach in comparing what companies say and what they do.

Key results

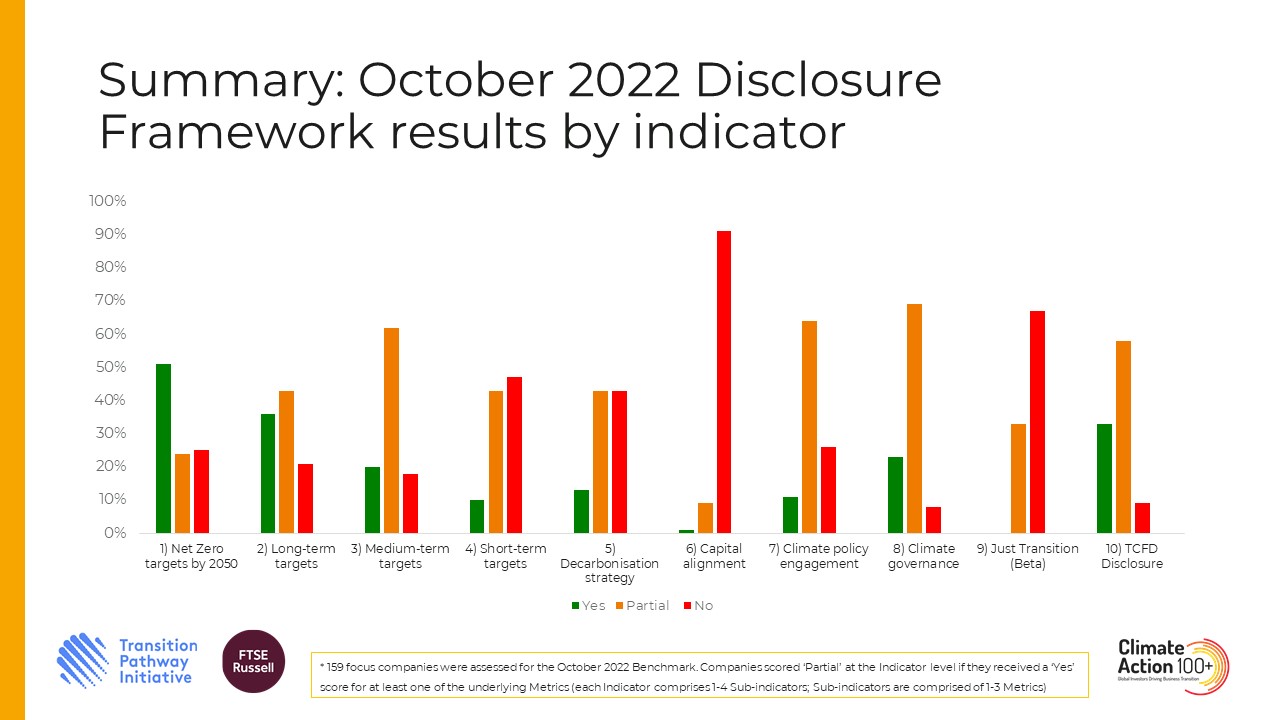

The updated assessments released today show that focus companies have continued to improve their disclosures, as shown by the Disclosure Framework, since the March 2022 release of Benchmark assessments. Driven by engagement from Climate Action 100+ investor signatories, the results show that:

- 75% of focus companies have now committed to achieve net zero emissions by 2050 or sooner across all or some of their emissions footprint (up from 69% in March 2022). In addition, over a third of focus companies have set long-term targets that align with a 1.5°C pathway (an increase of 9% from March 2022).

- 92% of focus companies have some level of board oversight of climate change (slight increase from 90% in March 2022).

- 91% of focus companies have aligned with TCFD recommendations either by supporting the TCFD principles or by employing climate-scenario planning (small increase from 89% in March 2022).

When Climate Action 100+ launched at the end of 2017, only five focus companies had set net zero commitments[4]. Investor engagement through the initiative has played a significant role in accelerating the net zero journey of focus companies, particularly around its three engagement goals of cutting greenhouse gas emissions, improving climate governance, and strengthening climate-related financial disclosures. This reinforces the value of Climate Action 100+ in facilitating targeted engagement that has resulted in a tangible impact at some of the world’s largest corporate emitters.

However, the encouraging uptake of net zero commitments is not matched by the development and implementation of credible decarbonisation strategies. As a priority, investors need to see corporates outlining the practical actions on how they will begin to meet their net zero commitments.

Specifically, the assessments reveal:

- An absence of short and medium-term emissions reductions targets aligned with limiting warming to 1.5°C. Whilst 82% of focus companies have set medium-term targets, only 20% have established ambitious medium-term targets that cover all material scopes and are aligned with a 1.5°C pathway. Only 10% of focus companies have set short-term targets (up to 2025) that are aligned with a 1.5°C scenario and cover all material emissions.

- Net zero targets are often not supported by strategies to deliver them. Although 53% of companies have a decarbonisation strategy in place to reduce their GHG emissions, only 19% of focus companies quantify key elements of their decarbonisation strategies with respect to the major sources of their emissions, including Scope 3 emissions where applicable.

- Scope 3 emissions remain absent. Only half (51%) of focus companies have comprehensive commitments for net zero by 2050 or sooner that cover all material GHG emissions, including material Scope 3 emissions.

- Alignment of capex strategies with net zero transition goals largely remain missing. Only 10% of companies have committed to fully align their capex plans with their GHG targets or the Paris Agreement. However, this is still a positive improvement since the previous Benchmark round and considering that very few focus companies score on Indicator 6 (Capital Alignment) at all.

Disclosure Framework results from the October 2022 Benchmark public summary of results – full presentation here.

The Alignment Assessments, which complement the Benchmark’s Disclosure Framework by measuring implementation of Paris-aligned corporate actions, indicate that despite continued progress on some disclosure indicators, the majority of focus company’s actions are still inadequate in aligning with the Paris Agreement.

Additionally, the Alignment Assessments indicators show:

- Less than one third (8 out of 32) of electric utility focus companies have a coal phase-out plan consistent with limiting global warming to below 2°C (not 1.5°C), according to Carbon Tracker Initiative (CTI) data. This is unchanged from the March 2022 Benchmark.

- No change for oil and gas focus companies. Almost two thirds (61%) sanctioned projects that are inconsistent with limiting global warming to below 2°C (not 1.5°C) in 2021, finds CTI.

- A step change is still needed in the build out of low carbon technologies by electric utility as well as automotive focus companies. Analysis by the Rocky Mountain Institute using the PACTA methodology shows that 94% of electric utility focus companies do not plan to build out sufficient renewable energy capacity and are on a >2.7°C global warming pathway for the next 5 years. Only 17% of automotive focus companies are planning to produce enough electric cars in the next 5 years to be aligned with the IEA Net Zero Emissions by 2050 scenario, whilst no steel, cement, or aviation focus companies’ emissions intensities are aligned with limiting global warming to either 1.5°C or below 2°C.These conclusions are unchanged from the March 2022 Benchmark.

- The climate policy engagement activities of focus companies and their industry associations remain a barrier to ambitious climate policy. According to InfluenceMap data, only 10% of focus companies have broad alignment between their direct climate policy engagement activities and the Paris Agreement (this is virtually unchanged since the March 2022 Benchmark), and only 4% align their indirect climate policy engagement via industry associations with the Paris Agreement (this is up from a mere 2% in the March 2022 Benchmark).

- The widespread failure to integrate climate risks into accounting and audit practices persists. No focus company met all criteria of the initiative’s provisional assessment on climate accounting and audit evaluated by CTI and the Climate Accounting and Audit Project (CAAP). However, three focus companies have become the first to demonstrate the impact on their financial statements using assumptions consistent with achieving net zero emissions by 2050.

Members of the Climate Action 100+ global Steering Committee join investor calls for stepped up climate ambition and action:

Andrew Gray, Director, ESG and Stewardship at AustralianSuper and current chair of the global Climate Action 100+ Steering Committee: “Through Climate Action 100+, investors have helped many heavy emitting companies make progress on transitioning to net zero but, as these assessments show, that progress needs to accelerate. Companies need credible strategies and capital expenditure plans to deliver on their net zero targets.”

Rebecca Mikula-Wright, CEO of AIGCC and IGCC and current vice-chair of the global Steering Committee: “Companies are making net zero commitments, but investors want those companies to turn intentions into concrete short- and medium-term actions to provide the confidence they can get to net zero. Corporate leaders can and should use each new round of Climate Action 100+ Benchmark assessments to demonstrate their ambitious climate action.”

Seiji Kawazoe, Senior Stewardship Officer at Sumitomo Mitsui Trust Asset Management and a member of the global Steering Committee: “Corporate engagement in Asia over the last five years via Climate Action 100+ has delivered meaningful results. We now need to see even greater progress from companies, namely on developing and implementing credible transition plans to help investors understand companies’ current stage of transition and their plans to reach net zero emissions. The Climate Action 100+ Benchmark is a complementary tool which provides investors with a clear view of where companies are positioned amongst their peers, both regionally and globally.”

Simiso Nzima, Managing Investment Director of Global Equity at CalPERS and a member of the global Steering Committee: “Now more than ever, we must focus our attention on getting companies to take real action, beyond just setting targets for their decarbonization efforts. The global climate risks from unfulfilled commitments are far too high. The Climate Action 100+ Net Zero Company Benchmark helps investors track the progress that companies are making and hold them accountable. CalPERS is fully committed to using its voice and its rights as a shareowner to ensure companies are carrying out their commitments and allocating capital in a way that makes them more sustainable while providing the long-term financial results necessary to serve our fund and members.”

Mindy Lubber, Ceres CEO and President and a member of the global Steering Committee: “North American focus companies are increasingly taking the important first step of making ambitious climate commitments. Yet time is short, and the climate crisis is intensifying. We need to see companies take concrete, near-term action to reach those goals and accelerate their development of credible decarbonization strategies. The conversation with North American companies has changed from ‘Will you hit net zero? to ‘What near- and medium-term actions will you take to get there?’ The global increase in net-zero targets should continue to embolden policymakers to take action that will support these commitments and accelerate their achievement.”

Stephanie Maier, Global Head of Sustainable and Impact Investment at GAM Investments and a member of the global Climate Action 100+ Steering Committee: “While the advances made on net zero commitments during the first phase of Climate Action 100+ are significant and welcome, the interim Net Zero Company Benchmark ultimately shows that focus companies are still a long way from aligning with the goals of the Paris Agreement. The timely release of these results, will support investors, many of whom have made their own net zero commitments, in their corporate engagement and escalation strategies in the run up to next year’s AGM season, where we expect continued focus on credible transition plans.”

Stephanie Pfeifer, IIGCC CEO and a member of the global Steering Committee: “Looking back over the last five years of Climate Action 100+ there has been demonstrable progress, particularly in Europe, by some of the world’s largest carbon emitting companies in acting on climate change; in this regard Climate Action 100+ has clearly been a force for good. However, we must be under no illusion about the need for more urgent action by all companies and impactful corporate engagement by investors to support global efforts to limit the temperature rise to 1.5°C. The challenge – and opportunity – for phase two of the initiative is clear.”

François Humbert, Lead Engagement Manager at Generali Insurance Asset Management (Generali Group) and a member of the global Steering Committee: “The publication of the October 2022 Benchmark update is the perfect milestone to feed the consultation which will start right after to make it an even more efficient tool. Given the current environment, the Just Transition indicator will be of high attention in the future.”

David Atkin, CEO of PRI and a member of the global Steering Committee: “We welcome strong progress on a number of the important indicators included around this most recent iteration of the Climate Action 100+ Benchmark. However, we know we need to see ambitious action taken further and faster on important indicators – including a stronger focus on short-to-medium term action, to help pursue efforts to reach a 1.5C pathway. Only through a coordinated commitment to action on a global scale will we see the change we so vitally need.”

Research and data organisations involved in the Benchmark provided comments:

Valentin Jahn, TPI Lead Research Analyst and TPI Climate Action 100+ Project Lead: “The Climate Action 100+ Net Zero Company Benchmark analyses some of the largest corporate emitters in the world; movement towards carbon neutrality by any one of them represents large scale change. While the increase in net zero ambition continues, we are now also seeing indications that companies are getting more serious about implementing actions to meet these net zero ambitions. This is shown by the increase in decarbonisation strategies and capital expenditure plans detailing how companies will actually transition. What we need now is more ambitious short- and medium-term targets to ensure that we don’t exceed our carbon budget on the way to net zero 2050.”

Cornelia Andersson, Group Leader, Sustainable Finance and Investment at London Stock Exchange Group (LSEG): “We are pleased to continue our partnership with Climate Action 100+ by providing critical insights and data underpinning the latest Net Zero Company Benchmark assessments. This common and transparent yardstick is critical for an informed discussion between management and investors on the real-world transition efforts of large emitters.”

Barbara Davidson, Head of Accounting, Audit, and Disclosure at Carbon Tracker Initiative: “Despite requirements to do so, the financial impacts of climate risk have not been integrated into financial reporting. As a result, investors do not have all the resources needed to push companies to confront the realities of the coming low carbon economy. To tackle this problem, throughout 2022 the Climate Accounting and Audit and Capital Allocation Alignment Assessments have identified the need for better transparency and highlighted inconsistencies across companies’ climate narratives. If companies are serious about meeting net-zero targets now is the time for companies to step up and show us not only the extent of their progress but the current financial impacts of achieving these goals.”

Maarten Vleeschhouwer, Head of PACTA at Rocky Mountain Institute: “Our contribution to the latest Benchmark assessments show we’re a long way from net zero. There’s no shortage of net zero commitments, but focus companies in the electric utility, automotive, steel, cement and aviation sectors have a clear gap in implementation over the next 5 years. This is most notable for investment in low carbon technologies. Our PACTA-based analysis shows that 94% of electric utilities are not scaling up renewable power capacity fast enough, putting them on a >2.7oC pathway or that technology. Auto manufacturing is a similar story, with only 17% planning to produce enough electric cars over the next 5 years.”

Joe Brooks, Program Manager, Climate Action 100+ and Investor Engagement at InfluenceMap: “It is impossible for a company to be truly aligned with net zero unless it is supporting science-based government policy on climate. The release of the Global Standard on Responsible Climate Lobbying earlier this year sets out how companies can achieve a step-change towards aligning their advocacy with 1.5°C. While this has led to an uptick in transparency and disclosure on this issue, only a handful of companies have improved their real-world policy engagement. Most Climate Action 100+ focus companies and their industry associations continue to block the policy measures needed to deliver on net zero in line with the goals of the Paris Agreement.”

Phase two and new public consultation on Net Zero Company Benchmark

This is the final round of Benchmark assessments to be published by Climate Action 100+ in the initiative’s first phase. The investor networks that deliver Climate Action 100+ plan to announce details on the strategy for phase two in H1 2023, ahead of a phased implementation from mid-2023.

The initiative is also today announcing a public consultation on a set of proposals to enhance the Net Zero Company Benchmark. The Benchmark is cited as a crucial tool by many of the initiative’s signatories and wider stakeholders for measuring company progress and identifying engagement priorities.

As Climate Action 100+ enters its second phase in 2023, the initiative is enhancing the Benchmark to ensure that it continues to effectively support investor engagements with focus companies and drives greater company ambition and action on climate change in the critical period up to 2030.

About the Climate Action 100+ Net Zero Company Benchmark (October 2022)

This is the third round of Net Zero Company Benchmark assessments to be released by Climate Action 100+ since March 2021. For this iteration, companies were given the opportunity to provide additional disclosures or commitments, announced between 1st January 2022 and 13th May 2022, to improve on their Benchmark results published in March 2022 (which incorporated disclosures published through 31st December 2021).

Benchmark assessments for 14 Australian focus companies were released early on 9 September as part of this interim update, to provide investors with updated Benchmark data for these companies ahead of AGMs in September and October.

About Climate Action 100+

Climate Action 100+ is the world’s largest investor engagement initiative on climate change. It involves 700 investors, responsible for over $68 trillion in assets under management. Investors are focused on ensuring 166 of the world’s biggest corporate greenhouse gas (GHG) emitters take the necessary actions to align their business strategies with the goals of the Paris Agreement. This includes improving corporate governance of climate change, reducing GHG emissions, and strengthening climate-related financial disclosures.

The 166 focus companies include the initial 100 ‘systemically important emitters’, identified with the highest combined direct and indirect GHG emissions, and additional companies selected by investors as critical to accelerating the net zero transition.

Launched in 2017, Climate Action 100+ is coordinated by five investor networks: Asia Investor Group on Climate Change (AIGCC); Ceres (Ceres); Investor Group on Climate Change (IGCC); Institutional Investors Group on Climate Change (IIGCC) and Principles for Responsible Investment (PRI). These organisations, along with investor representatives from AustralianSuper, California Public Employees’ Retirement System (CalPERS), GAM Investments, Generali Insurance Asset Management (Generali Group) and Sumitomo Mitsui Trust Asset Management form the global Steering Committee for the initiative. Follow us on Twitter: @ActOnClimate100.

—

[1] March 2022 Benchmark assessments – press release.

[2] 159 out of the total 166 focus companies are being assessed for the third iteration of the Net Zero Company Benchmark. This excludes 5 Russian companies with whom investor signatories have paused active engagement and reflects the recent mergers between Santos and Oil Search in December 2021 (Santos now assessed) and the separation of Exelon Corporation into Exelon and Constellation in February 2022 (neither assessed as not enough information available).

[3] Companies were given the opportunity to provide additional disclosures or commitments, announced between 1st January 2022 and 13th May 2022, to improve on their Benchmark results published in March 2022.

[4]BNEF analysis, September 2021: Two Thirds of the World’s Heaviest Emitters Have Set a Net-Zero Target.