As the world strives to meet the goals of the Paris Agreement, economy-wide decarbonisation must be an urgent priority. The impacts of decarbonisation will differ across countries, companies and sectors. While evidence shows that a resilient, net-zero economy boosts prosperity and creates more jobs than are lost[1], workers, communities and other stakeholders currently dependent on emissions-intensive industries will nonetheless face transitional, location-specific challenges.

The Paris Agreement makes clear that national actions on climate change must ensure a just transition for the workforce by creating high-quality jobs in accordance with nationally defined development priorities.

It is therefore imperative that companies account for these challenges in their climate transition plans. Companies that do not address these risks may face not only stranded assets but also stranded workers and communities[2] , along with the loss of their social license to operate. Through broader macroeconomic shifts, these risks impact both individual companies and investment portfolios.

As decarbonisation accelerates, investors are looking for companies to demonstrate that they are planning proactively to protect long-term value and mitigate severe disruption to the economy, while ensuring that workers and communities are given a fair opportunity to transition into new, sustainable livelihoods. This is what it means to plan for a just transition.

Members of the global Climate Action 100+ Steering Committee commented:

“People are at the heart of the energy transition to net zero. The Paris Agreement is framed by the commitment to a just transition to ensure the workforce, communities, indigenous peoples, and the vulnerable, including women and migrants, are fully included in transition planning to a low carbon economy. The Climate Action 100+ Benchmark now includes this vital element and we applaud those companies which are starting to map out their transition plans, with inclusion as a core commitment. More is needed, at pace and scale. That is a moral imperative and an economic necessity.” Anne Simpson, Global Head of Sustainability at Franklin Templeton and a member of the global Climate Action 100+ Steering Committee.

“It is part of our fiduciary duty to mitigate long-term risk, which includes risks to those affected by the net zero transition of emissions intensive industries. It is critical that we are engaging with companies to not only seize the opportunities of the net zero transition but to mitigate any negative impacts this may have on workers. But the just transition must go beyond labour and be addressed in communities and across entire supply chains, including considerations on energy availability, reliability and affordability as stated in Sustainable Development Goal 7. This is especially valid for countries whose energy mix heavily depends on fossil fuels. We have recently experienced the social impacts of high energy prices.” François Humbert, Lead Engagement Manager at Generali Insurance Asset Management and a member of the global Climate Action 100+ Steering Committee.

“A just transition to a net zero emissions economy in Asia offers many opportunities. With energy demand expected to continue to grow in the region over the next decade, increasing clean energy supply and reliability will be essential. In addition, avoiding negative impacts of local pollution and protecting those who are the most vulnerable to climate change in a society’s just transition to net zero is critically important. Partnerships, such as the Southeast Asian Energy Transition Partnership, can play a vital role in accelerating the transition in the region by ensuring energy infrastructure is upgraded in a just and affordable manner.” Seiji Kawazoe, Senior Stewardship Officer at Sumitomo Mitsui Trust Asset Management and current chair of the global Climate Action 100+ Steering Committee.

The need for action now

The net zero transition is no longer constrained to the future. We have already seen job losses in the shift away from coal. Dropping technology costs, increasing demand for clean energy, and favorable policy shifts has led to record rates of clean energy deployment – paving the path for a clean energy workforce and highlighting a need for retraining and redeploying workers in the energy sector. The net zero transition also provides a near-term opportunity to address energy equity disparities through clean energy programs that aim to support financially vulnerable customers.

Successfully planning for a just transition will not be a one-step process for companies and must be developed through ongoing consultation with relevant stakeholders. As technology and changes in regulations incentivise more ambitious greenhouse gas targets and decarbonisation plans, just transition plans should be updated to reflect the necessary pace and scale of action.

Measuring company progress on just transition

In March 2022, Climate Action 100+ released the second round of Net Zero Company Benchmark (“Benchmark”) assessments[3]. The Benchmark measures company disclosure on climate change-related issues and evaluates the actions that the initiative’s focus companies are taking to reduce emissions and help meet critical global climate goals.

Climate Action 100+ recognises that a just transition must be a key component of the global shift to net zero emissions in accordance with the Paris Agreement. As a result, Climate Action 100+ integrated a Just Transition indicator into the Benchmark disclosure framework for the first time in 2022[4].

About the indicator

The Just Transition indicator’s development was informed by leading international policy documents including the Paris Agreement and the International Labour Organization’s (ILO) Just Transition Guidelines, and was developed in consultation with global topic experts and investors.

At its core, the Just Transition beta indicator (Box 1) calls for companies to develop a Just Transition plan or policy in coordination with relevant stakeholders, including but not limited to workers, unions, communities, and other actors within the supply chain.

BOX 1: Disclosure Indicator 9 – Just Transition [Beta]Sub-indicator 9.1 Acknowledgement Metric a) The company has made a formal statement recognising the social impacts of their climate change strategy—the Just Transition—as a relevant issue for its business. Metric b) The company has explicitly referenced the Paris Agreement on Climate Change and/or the International Labour Organisation’s (ILO’s) Just Transition Guidelines Sub-indicator 9.2 Commitment | The company has committed to Just Transition principles: Metric a): The company has published a policy committing it to decarbonise in line with Just Transition principles. Metric b): The company has committed to retain, retrain, redeploy and/or compensate workers affected by decarbonisation. Sub-indicator 9.3 Engagement | The company engages with its stakeholders on Just Transition: Metric a): The company, in partnership with its workers, unions, communities and suppliers has developed a Just Transition Plan. Sub-indicator 9.4 Action | The company implements its decarbonisation strategy in line with Just Transition principles. Metric a): The company supports low-carbon initiatives (e.g. regeneration, access to clean and affordable energy, site repurposing) in regions affected by decarbonisation. Metric b): The company ensures that its decarbonisation efforts and new projects are developed in consultation with and seek the consent of affected communities. Metric c): The company takes action to support financially vulnerable customers that are adversely affected by the company’s decarbonisation strategy. Contingency between sub-indicators: Sub-indicators 9.2-9.4 will not be scored unless the requirements of 9.1 are met. 9.4a is contingent on 9.2a. For more details on how these elements of the indicator are scored, please see the Climate Action 100+ Net Zero Company Benchmark Disclosure Framework assessment methodology. |

The indicator is in beta form, as feedback and data are collected to inform further development. Individual company scores on the Just Transition indicator will not be released publicly until 2023. Introducing a beta indicator to the Benchmark provides an opportunity to test its methodology and demonstrates the initiative’s commitment to further consultation and development. In the interim, Climate Action 100+ investor signatories are engaged with companies to develop just transition plans and policies in coordination with relevant stakeholders.

Initial results

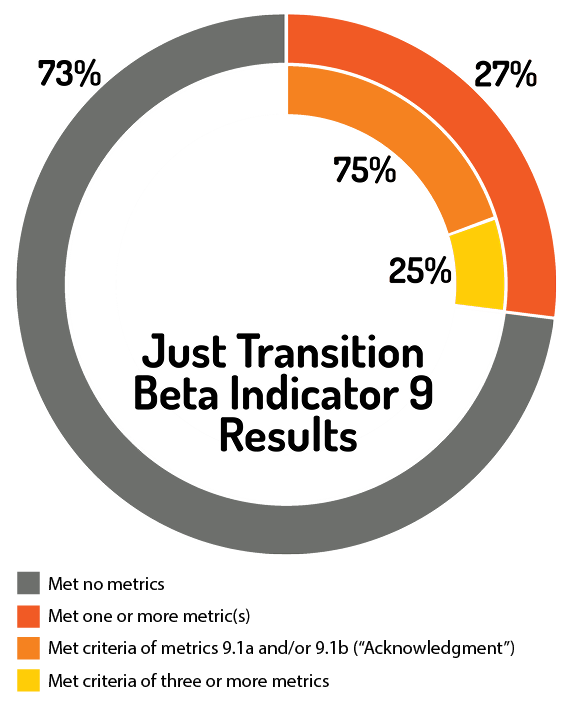

Data from the March 2022 Benchmark assessments shows that a majority of the largest global emitters are not sufficiently prepared to deliver a just transition. Aggregate global data follows:

Specifically, the assessments reveal that:

- 73% of Climate Action 100+ focus companies have not met any metrics of the Just Transition beta indicator.

- Only 27% of focus companies have met one or more metrics of the indicator.

- Of these companies, 75% (representing 44 companies globally) only meet the criteria of sub indicator 9.1a and/or 9.1b (“Acknowledgement”). These companies have taken a critical first step by explicitly acknowledging the importance of the issue, but they now must produce an accompanying Just Transition plan or policy. Commitments must be followed by specific plan and tangible actions.

- The other 25% (representing 11 focus companies globally) have made varying levels of progress against more advanced Just Transition actions (“Commitment”, “Engagement” and “Action”). These early movers are shaping “good practice” on Just Transition disclosure, a standard that is evolving quickly as more companies explore related transitional risks and opportunities.

- No company met all eight metrics of the indicator.

Increased investor focus and tools for engagement

Notably, the world’s largest asset managers have begun scrutinising corporate just transition planning and disclosure more closely. BlackRock acknowledged the business case associated with just transition planning, noting in a recent statement that “companies that consider the impact of the energy transition on their key stakeholders — employees, customers, and the communities in which they operate — will likely be best positioned over the long-term.”[5] State Street Global Advisors identified just transition as one of ten key areas of climate transition disclosure. State Street also committed to engage large emitters in carbon intensive sectors on climate transition plan disclosure in 2022, and plans to escalate to director accountability in 2023 if companies fail to meet its disclosure expectations.[6]

The broader investor community is taking steps to ensure stronger just transition disclosure and action. The 2020 Statement of Investor Commitment to Support a Just Transition on Climate Change[7], coordinated by PRI, was endorsed by 161 investors representing US $10.2 trillion in assets, committing their firms to support the just transition by integrating the workforce and social dimensions in their strategies to tackle climate change, including corporate engagement.

Investor engagement is publicly visible in the form of dialogue and shareholder resolutions. A recent investor letter, coordinated by a World Benchmarking Alliance multi-stakeholder coalition, calls on oil and gas companies to identify, prepare for, and mitigate the social impacts of their low-carbon strategies, including engaging in dialogue with workers, unions, local authorities and other stakeholders to develop just transition plans[8].

A 2022 just transition disclosure resolution at Marathon Petroleum filed by the International Brotherhood of Teamsters resulted in 16.5% support[9] – an impressive result on an emerging topic, demonstrating the saliency of this topic and reinforcing the notion that additional disclosure will allow shareholders to better assess the corporate efforts to manage and mitigate net zero transition risks.

You can’t fix what you don’t track

Transparency and stakeholder engagement go hand in hand. As just transition corporate disclosures expand and evolve, comparable data that can be used to inform decisions will become necessary. The new Climate Action 100+ Benchmark will help fulfill that need, as well as the World Benchmarking Alliance’s 2021 Just Transition Assessment, a first-of-its-kind public benchmark of 180 companies against 24 metrics[10]. Its methodology is complementary to, and aligned with, the Climate Action 100+ Benchmark Just Transition indicator.

The recent development of these tools reflects an increasing public attention and elevated investor expectations on just transition planning. They fulfill an urgent, growing need for measurable and comparable just transition metrics that will allow creation and evaluation of credible climate transition plans.

Footnotes:

[1] Article in World Economic Forum, 25 March 2022: https://www.weforum.org/agenda/2022/03/the-clean-energy-employment-shift-by-2030/

[2] Just Transition Centre report for the OECD, May 2017: https://www.oecd.org/environment/cc/g20-climate/collapsecontents/Just-Transition-Centre-report-just-transition.pdf

[3] March 2022 press release: https://www.climateaction100.org/news/climate-action-100-net-zero-company-benchmark-shows-an-increase-in-company-net-zero-commitments-but-much-more-urgent-action-is-needed-to-align-with-a-1-5c-future/

[4] Added as of March 2022 Net Zero Company Benchmark assessments. More information on the Benchmark methodology is available here: https://www.climateaction100.org/net-zero-company-benchmark/methodology/

[5]https://www.blackrock.com/corporate/literature/publication/blk-commentary-climate-risk-and-energy-transition.pdf

[6]https://www.ssga.com/library-content/pdfs/asset-stewardship/disclosure-expectations-for-effective-climate-transition-plans.pdf

[7] 16 April 2020: https://www.unpri.org/download?ac=10382

[8] 17 May 2022 press release: Investors write to 100 oil and gas companies urging them to put people at the heart of decarbonisation plans https://www.worldbenchmarkingalliance.org/news/investors-write-to-100-oil-and-gas-companies-urging-them-to-put-people-at-the-heart-of-decarbonisation-plans/

[9]https://engagements.ceres.org/ceres_engagementdetailpage?recID=a0l5c00000IXVKZAA5

[10] 1 November 2021 report: 2021 Just Transition Assessment https://www.worldbenchmarkingalliance.org/research/2021-just-transition-assessment/